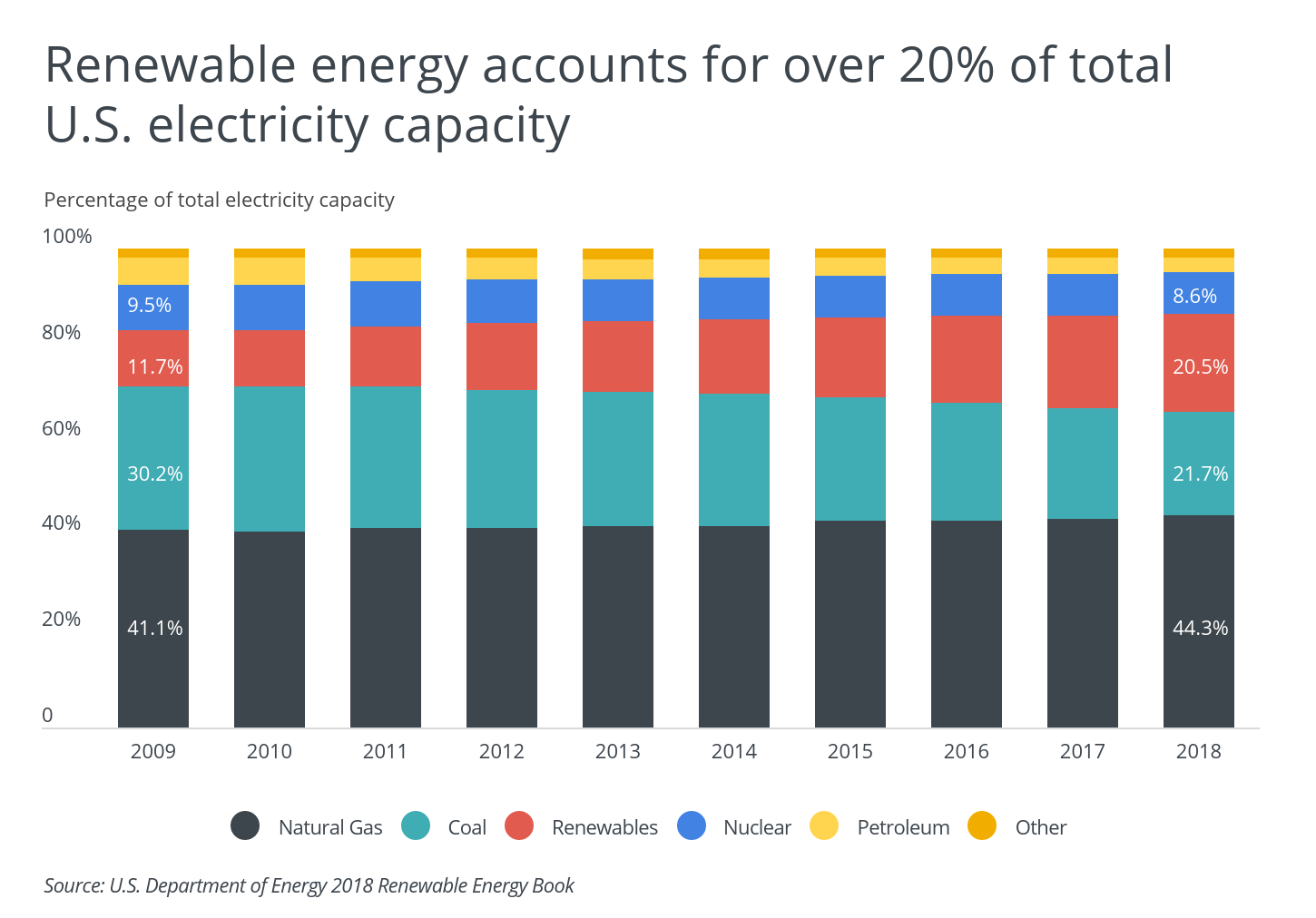

Energy M&A Deals 2025 - By 2025, onefourth of U.S. electricity will come from renewables EIA, Strong commodity prices have encouraged consolidation. Despite the recent backdrop of a challenging economic environment for buyouts and. Cities Investing the Most in Solar Energy Informed Infrastructure, Energy becomes bright spot in m&a dealmaking. Sustainability consulting and carbon markets.

By 2025, onefourth of U.S. electricity will come from renewables EIA, Strong commodity prices have encouraged consolidation. Despite the recent backdrop of a challenging economic environment for buyouts and.

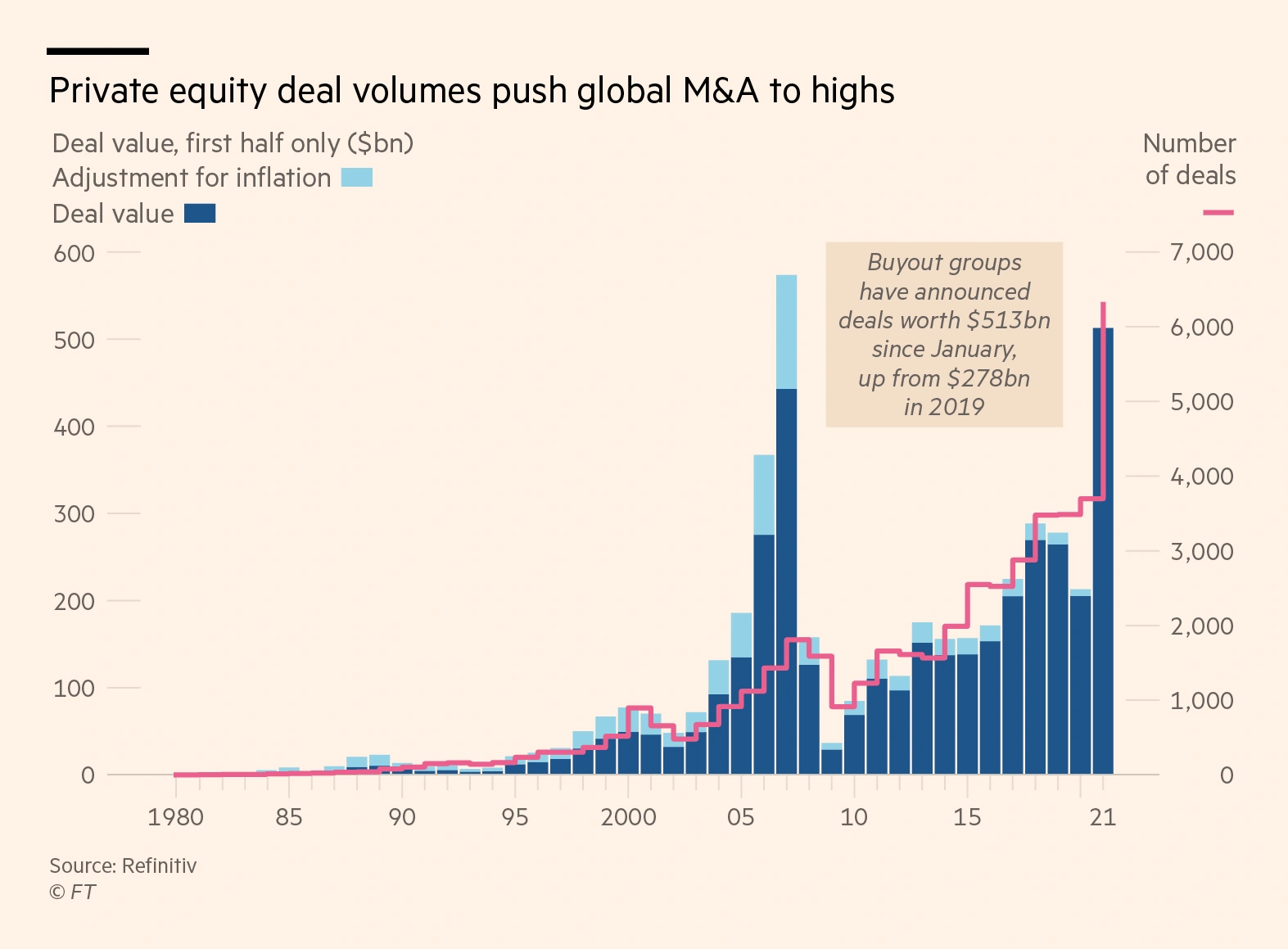

U.S. Renewable Energy M&A Review of 2021 and Outlook for 2022, Private equity deals could return as costs of financing begin to drop. Welcome to the institute for mergers, acquisitions, and alliances’ overview of the top global m&a deals 2025:

Diamondback's bid for endeavor tops 1q deal rankings.

.png?itok=7yW3MFZb)

Renewable Energy M&A Enerdatics, The energy m&a outlook going into 2025. Welcome to the institute for mergers, acquisitions, and alliances’ overview of the top global m&a deals 2025:

Energy M&A Deals 2025. Last year was a difficult year for investment banking and mergers and acquisitions (m&a). Notably, renewable and clean energy deals drove more than half of the deals in the last 12 months ending november 15, showcasing significant interest from a broad pool of.

After the biggest first quarter for global upstream dealmaking in five years, the industry could see another. Private equity deals could return as costs of financing begin to drop.

Renewable Energy M&A Enerdatics, Analysts expect bounce for m&a in 2025 after worst year for deals in a decade. M&a activity in the global upstream industry has already crossed the $64 billion mark this year, most of it focused around the u.s.

6 Important M&A Trends (20252025), Sustainability consulting and carbon markets. Will 2025 launch a bright new era for m&a?

After the biggest first quarter for global upstream dealmaking in five years, the industry could see another.

Renewable Energy M&A Enerdatics, I expect a sharp increase in m&a deals in the renewable energy sector in 2025, particularly in the solar and wind energy subsections. Notably, renewable and clean energy deals drove more than half of the deals in the last 12 months ending november 15, showcasing significant interest from a broad pool of.

SunCoke Energy Simplification Transaction M&A Call Presentation, I expect a sharp increase in m&a deals in the renewable energy sector in 2025, particularly in the solar and wind energy subsections. “most oil and gas companies are performing very well financially, with strong underlying trading.

2nd Energy M&A INVR, The energy sector has been a luminous part of m&a dealmaking. Imaa’s 2025 top global m&a deals industry coverage offers an overview of the year’s most significant m&a transactions across eight key industries.

Energy becomes bright spot in m&a dealmaking.

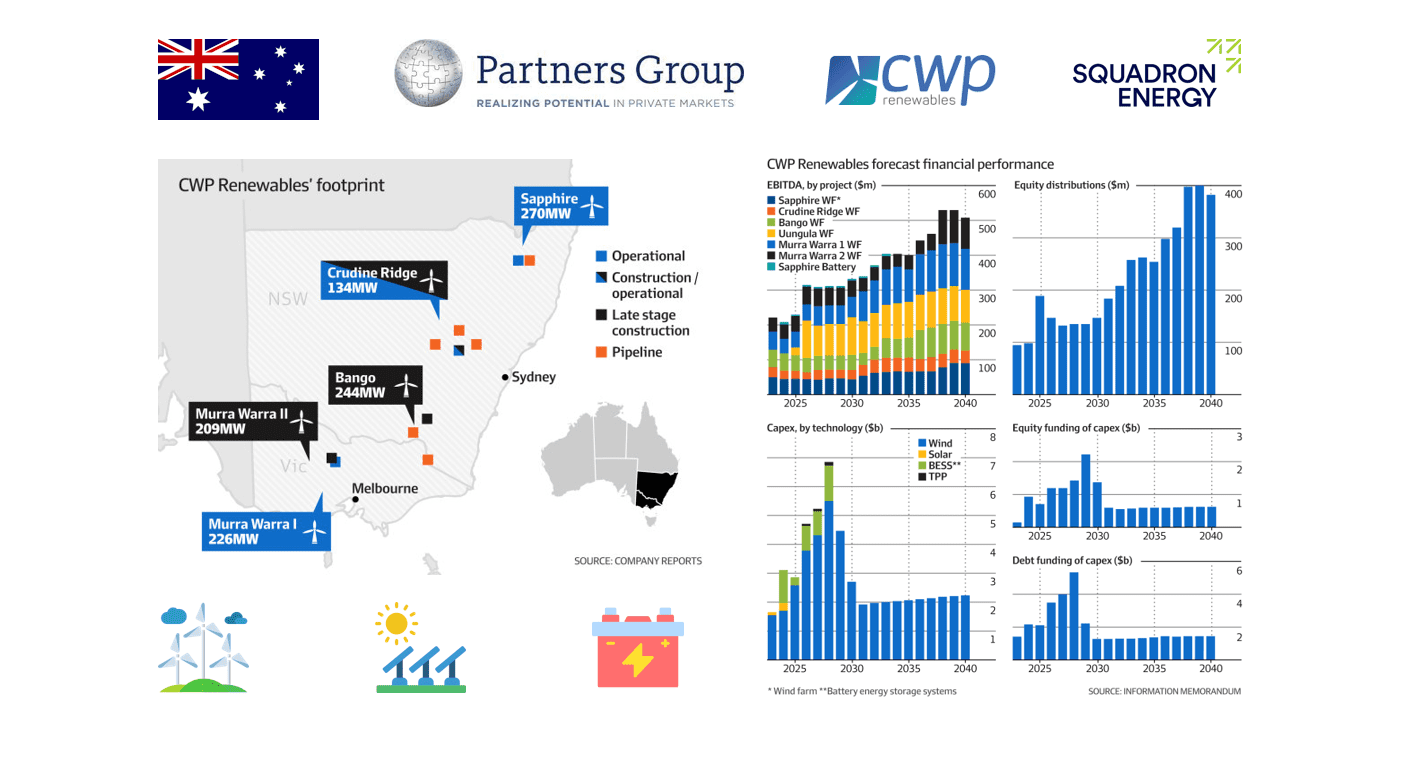

Renewable Energy M&A Partners Group sells Australian renewables pl…, Last year was a difficult year for investment banking and mergers and acquisitions (m&a). The energy sector has been a luminous part of m&a dealmaking.

M&a activity in the global upstream industry has already crossed the $64 billion mark this year, most of it focused around the u.s.